“Have you ever thought about what happens if you’re stuck abroad during a medical emergency? Spoiler: It’s not just the hospital bills that will keep you up at night.”

Repatriation insurance is the unsung hero of personal finance for globetrotters, expats, and anyone with wanderlust. But here’s the kicker—it doesn’t work unless you understand repatriation success rates. These rates determine how effectively your insurer can get you home safely and cover associated costs. In this guide, we’ll dive into why repatriation success rates matter, actionable steps to secure the best coverage, and tips to avoid pitfalls that might leave you stranded—literally.

You’ll walk away knowing:

- Why repatriation success rates should top your checklist when choosing insurance.

- A step-by-step roadmap to evaluate policies like a pro.

- Real-world examples of what happens when things go wrong (and right).

Table of Contents

- Key Takeaways

- Section 1: Why Repatriation Success Rates Are Critical

- Section 2: Step-by-Step Guide to Evaluating Insurance Policies

- Section 3: Top Tips for Maximizing Your Coverage

- Section 4: Case Study – A Tale of Two Travelers

- Section 5: Frequently Asked Questions About Repatriation Insurance

Key Takeaways

- Repatriation success rates measure how reliably an insurer delivers on returning policyholders to their home country in emergencies.

- Not all insurance plans are created equal; focus on providers with proven track records.

- Credit cards often offer built-in travel protections, but they may lack adequate repatriation coverage.

- Understand exclusions and fine print before purchasing any policy.

Why Repatriation Success Rates Are Critical

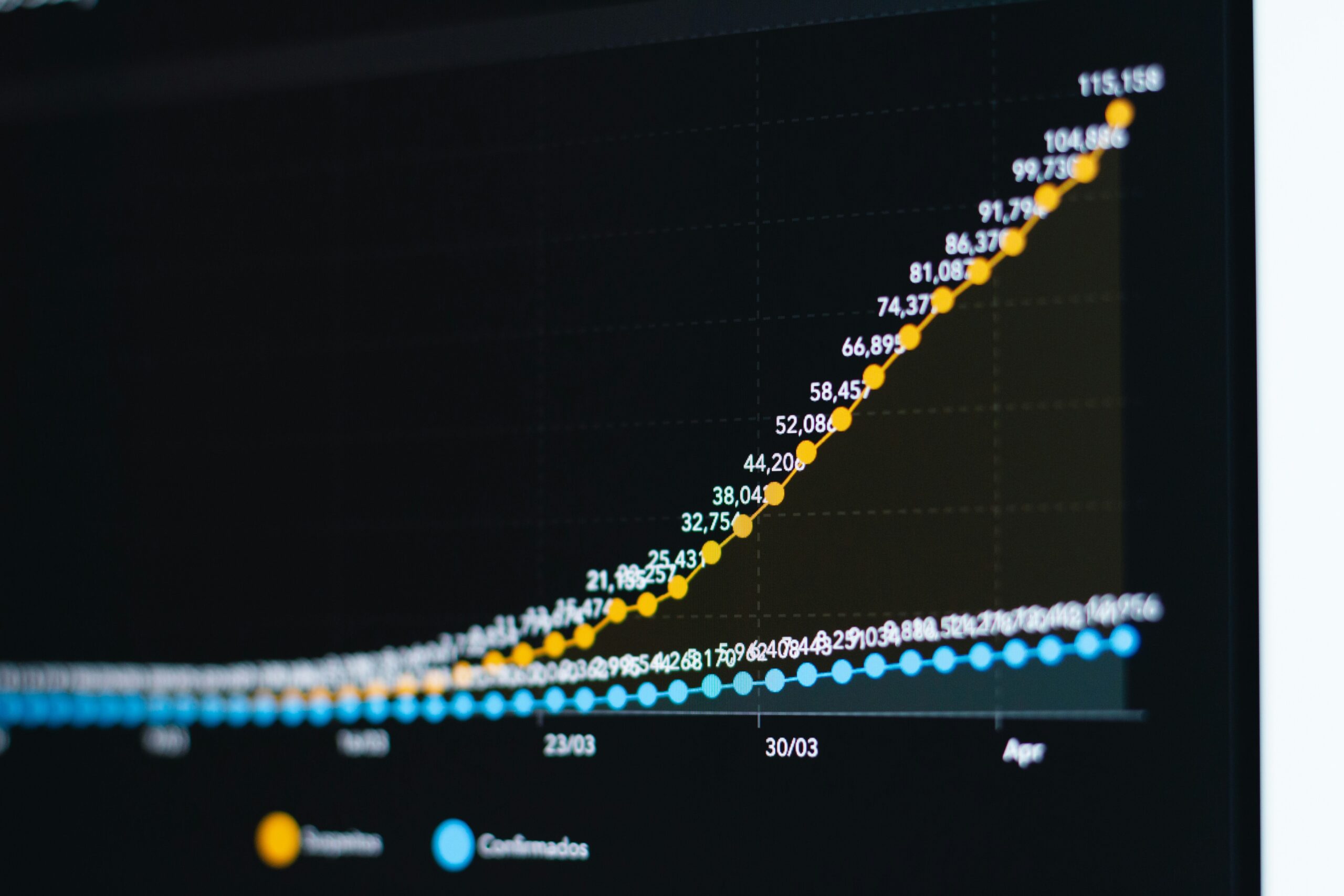

A comparison of repatriation success rates among leading insurance companies highlights huge disparities in performance.

Let’s talk turkey: What exactly are repatriation success rates? Simply put, these figures represent the percentage of claims where an insurer successfully covers and executes repatriation services. For instance, a company boasting a 90% success rate means 9 out of 10 customers got help coming home without hiccups.

Here’s why this metric matters:

- Peace of Mind: Knowing your insurer has a stellar reputation for resolving crises builds confidence.

- Cost Savings: Poorly performing insurers could leave you footing exorbitant evacuation bills.

- Hassle Avoidance: No one wants to deal with bureaucratic nightmares while recovering from surgery in a foreign hospital.

Confession time: Once, I skimped on research and ended up with a policy whose repatriation success rate hovered around 50%. When disaster struck, guess who had to navigate endless phone calls and delays? Yep, me. Lesson learned: Always dig deeper than flashy marketing!

“Optimist You” says, “This sounds manageable!” Grumpy You mutters, “Yeah, until you realize there are over 100 insurers out there vying for attention…”

Step-by-Step Guide to Evaluating Insurance Policies

Step 1: Research Provider Reputation

Start by checking reviews and testimonials online. Google “repatriation success rates + [insurer name]” for insights. Trustworthy sources include consumer forums, independent review sites, and even Reddit threads.

Step 2: Compare Coverage Details

Different policies offer varying levels of repatriation support. Look for specifics like:

- Emergency medical transport options

- Coordination with local hospitals

- Family member travel allowances

Step 3: Ask About Exclusions

Most policies exclude certain scenarios (e.g., pre-existing conditions). Don’t skip reading the fine print—it’s not as fun as scrolling Instagram, but it’s crucial.

Step 4: Consider Credit Card Perks

If you own premium credit cards, check whether they bundle repatriation benefits. Many do, though limits and terms vary widely.

Pro Tip: If your card offers limited coverage, consider upgrading or supplementing it with standalone insurance.

Top Tips for Maximizing Your Coverage

- Budget Wisely: Cheaper isn’t always better. Prioritize reliability over cost savings.

- Document Everything: Save receipts, emails, and doctor notes—just in case.

- Stay Updated: Insurance terms change frequently. Revisit your policy annually.

(Terrible Tip Alert!) One bad piece of advice floating around? “Just wing it—you probably won’t need it anyway.” Newsflash: Murphy’s Law loves travelers.

Case Study – A Tale of Two Travelers

Two travelers faced similar emergencies abroad—one chose wisely, while the other regretted cutting corners.

Meet Sarah and Jake. Both experienced sudden illnesses overseas. Sarah invested in a top-rated plan with an 88% repatriation success rate. Her insurer arranged smooth transportation home within days. Meanwhile, Jake opted for cheaper coverage with sketchy terms. His claim dragged on for weeks, leaving him stuck abroad longer than expected—and racking up hefty expenses.

Moral of the story? Insurance isn’t just another expense—it’s a lifeline.

Frequently Asked Questions About Repatriation Insurance

What Are Average Repatriation Success Rates?

Industry averages hover between 70% and 90%, depending on the provider. Aim for insurers closer to the upper end for maximum reliability.

Does My Credit Card Cover This?

Some high-end cards include partial repatriation assistance, but coverage caps and restrictions apply. Read your agreement carefully.

Can I Switch Providers Mid-Trip?

Typically, no. Most insurers require enrollment prior to departure. Plan ahead!

Conclusion

Navigating repatriation insurance doesn’t have to feel like decoding ancient hieroglyphs. By focusing on success rates, understanding policy nuances, and avoiding rookie mistakes, you can safeguard your travels—and your finances. Remember, preparation beats panic every single time.

Like a Tamagotchi, your insurance needs daily care—or at least annual check-ups—to thrive. Safe journeys!